您们的需要 我们的专注

Your Needs Our Focus

财经快讯

市場最關注的數據!渣打:下周美國4月CPI可能送降溫“驚喜”

上月公佈的美國3月CPI同比超預期加快增長,環比連續五個月增速高於預期,核心CPI三個月增速高於預期,重創了市場的降息預期。上周會後美聯儲主席鮑威爾否認下一步很可能加息,但傳遞的信號顯示降息時間更不確定。有“新美聯儲通訊社”之稱的記者Nick Timiraos此後撰文稱,市場認定美聯儲的傾向已經沒有那麼重要,更關鍵的是經濟和通脹數據。

美聯儲會後,下周三將公佈的4月CPI就是打頭炮的重磅通脹數據。CPI會不會再次超預期增長,打擊市場的降息信心?渣打銀行的首席外匯策略師Steven Englander新近報告指出,如果密切觀察住房成本,特別是CPI中的住房通脹相關指標——自住房業主等價租金(OER),就會發現,有理由樂觀地預計,住房通脹可能很快下行,並且拉動核心通脹下行。

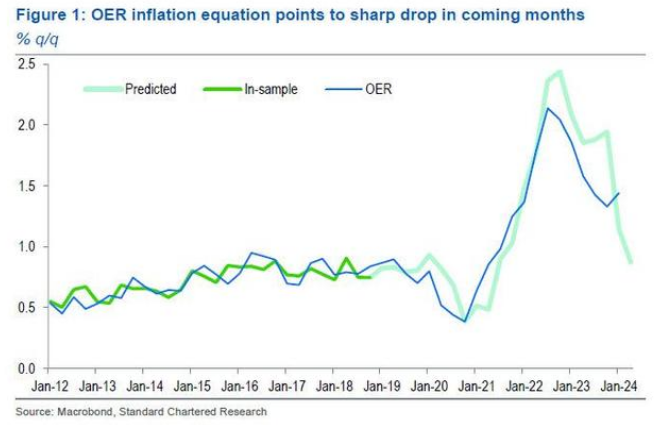

上周鮑威爾會後表現得對未來住房成本下降可能降低核心通脹有信心。如下圖所示,Englander 對實際和預測的 OER 進行了回歸分析,發現“鮑威爾的樂觀情緒可能是合理的”,因為分析顯示,“基於近年來已證明穩定的回歸,未來幾個月OER將急劇下降”。

Englander的分析基於美聯儲和美國工統計局(BLS)研究人員構建的新租戶租金和所有租戶租金實驗系列,即使在2012年到19年間估算,回歸也能給出良好的OER樣本外預測。從圖表中可以看出,回歸結果表明,今年第一季度的OER上漲是一種異常現象,未來幾個月將恢復下行壓力,而且下行壓力“可能急劇”。

Englander預測的第二季度平均OER通脹僅環比增長0.29%,和2015年到2019年的普遍幅度相差不遠,較今年一季度的OER環比增速0.48%放緩。這是很重要的變化,因為OER在核心CPI中的權重達到33%,所以OER這種預測幅度的增速放緩將會讓核心CPI環比下降0.06個百分點,這意味著,如果有更多的CPI組成部分通脹降溫,核心CPI增速將可能比預期水準0.3%低,增速放緩至0.2%,甚至可能更低。

Englander分析OER追蹤的是滯後的私人部門市場租金數據,該領域的數據最近已經下降。他認為,OER通脹未來幾個季度將繼續疲軟。他的結論是,這種OER放緩將激勵人們預期通脹會重啟下行,且降幅足以讓美聯儲開始降息。

同時,Englander指出,他的結論有兩大失誤的風險。一是BLS和美聯儲關於新租戶和所有租戶租金的實驗數據是按季度發佈的,因此,他對季度變化的判斷可能是正確的,但對月度變化的判斷可能有誤。去年BLS改動了測算方法,這意味著,OER目前依據單戶出租房屋的小樣板進行估算,這帶來了OER數據隨機波動的可能。二是,對單戶住宅的大量需求可能導致租金不成比例地上漲,並將持續這樣上漲。不過,大多數業主會鎖定較低的抵押貸款利率,不會面臨住房成本增加。

Englander提及,他注意到上周鮑威爾說了這樣一句話:考慮到目前市場租金的情況,我仍然預計,這些租金將隨著時間推移體現在可衡量的住房服務通脹中。Englander指出,鑒於一季度的OER通脹較高,鮑威爾這種對住房通脹的信心讓他吃驚。而且,鮑威爾看來不再專注於所謂的超級核心通脹——剔除食品、能源和住房租金的服務,轉而關注降低的租金通脹作為降息的充分理由,這一點也讓他吃驚。

風險提示及免責條款

市場有風險,投資需謹慎。本文不構成個人投資建議,也未考慮到個別用戶特殊的投資目標、財務狀況或需要。用戶應考慮本文中的任何意見、觀點或結論是否符合其特定狀況。據此投資,責任自負。